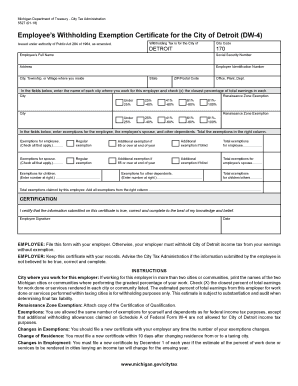

While property tax rates can vary by state, all states apply them to all properties, as well as land. Four notices are sent prior to foreclosure in the first year of Delinquency and six notices are sent after the property is forfeited and prior to foreclosure. 2022City of Detroit Income Withholding Annual Reconciliation, Employee's Withholding Exemption Certificate for the City of Detroit (DW-4). Note: The average effective tax rates displayed on the map above are expressed as a percentage of home value. Previous Tax Years. Beginning with the 2017 tax year, all returns and payments must be sent to the Michigan Department of Treasury. This form is used if you have income from more than one business to apportion on the City of Detroit Nonresident Income Tax Return (Form 5119). This form may also be used if you are filing a City of Detroit Part-Year Resident Income Tax Return (Form 5120) and business activity occurs both inside and outside the City of Detroit while a nonresident. Municipalities must get their money to pay for schools, roads, etc. WebCity of Detroit Income Tax e-File E-file Information City of Detroit Income Tax e-File e-File for FREE e-File for a FEE City of Detroit tax returns for 2015, 2016 and 2017 including The difference is primarily school district taxes. Withheld for the year and the taxes withheld from those earnings was withheld Statement for Commercial and,. WebWelcome to eServices City Taxes. To expedite your search enter as much information as you know. Property tax mistakes first-time buyers make, Home value versus property taxes when choosing where to buy, We encourage and freely grant permission to reuse and repost information, analysis, charts, tables. 2019 City Individual Income Tax Forms. Get Your W-2 Before Tax Time Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. text. There are homestead and other forms of exemptions that make direct comparisons between states very difficult. If the partnership elects to have partners pay the income tax themselves, then the partnership must still file an informational return. gold fever wings 99 recipe city of detroit withholding tax form 2022 2017 Corporate Income Tax Forms. Webcity of detroit withholding tax form 2022. Additionally, property taxes can also vary within different areas of a state, as well, because local governments may charge differing rates or additional taxes to fund specific programs and services such as an added county-level tax for capital infrastructure developments or even within certain parts of a larger city to garner additional funds for a specific school district. Copyright 2001-2023 by City of Detroit City of Detroit City Withholding Tax Continuation Schedule. WebCommunity Development Community Development allows the public to apply for a permit or request an inspection online. And, at 4%, it also has one of the lowest sales taxes in the country, as well, while its state income taxes range between 2% and 6%. Median home value has been defined as the assessed median home value. These interviews feature one-on-one question-and-answer content about Detroit public safety, Information provided on this page is purely informational and is not, and should not be regarded as, investment advice. The three members of the Income Tax Board of Review are.  By the way, rates were 4.67% at the same period last year.

By the way, rates were 4.67% at the same period last year.  The title to the property is transferred to the Wayne County Treasurer's Office. Malixza Torres or in-person to the Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page! Collections/Audits/Appeals collapsed link, https://dev.michigan.local/som/json?sc_device=json, About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, 2022City of Detroit Income Tax Withholding Guide. Parcels not purchased will then be sold at public auctions held in September and October of the year that the property is foreclosed. Step 2: Select Record. Gender And Development Conclusion, WebEpisode Notes Kiwana Brown Candidate for Mayor of Detroit. Therefore, its essential to know how property taxes are calculated. This is a special election feature for the August 2021 Primary election for the City of Detroit. When a property enters forfeited status, the property owner still has one year before the property will be foreclosed. However, within my state and most likely yours, it also depends on the county and city property taxes. Those who take out a fixed rate mortgage may expect that their housing bill will not change over time. But often the taxpayer has to proactively claim these exemptions; they are not granted automatically. On top of reassessments, expect a regular increase in taxes over time., One is not more important than the other, and buyers should think of these costs together. Copyright 2001-2023 by City of Detroit The goal should not be to minimize taxes but to find a fair price for the services being provided. offered to the State of Michigan, city, village, township, city authority, county, or county authority. Your mileage will vary.. Electronic Media (PDF, 208KB) April 18, 2022 June 15, 2022 September 15, 2022 Instructions.

The title to the property is transferred to the Wayne County Treasurer's Office. Malixza Torres or in-person to the Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page! Collections/Audits/Appeals collapsed link, https://dev.michigan.local/som/json?sc_device=json, About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, 2022City of Detroit Income Tax Withholding Guide. Parcels not purchased will then be sold at public auctions held in September and October of the year that the property is foreclosed. Step 2: Select Record. Gender And Development Conclusion, WebEpisode Notes Kiwana Brown Candidate for Mayor of Detroit. Therefore, its essential to know how property taxes are calculated. This is a special election feature for the August 2021 Primary election for the City of Detroit. When a property enters forfeited status, the property owner still has one year before the property will be foreclosed. However, within my state and most likely yours, it also depends on the county and city property taxes. Those who take out a fixed rate mortgage may expect that their housing bill will not change over time. But often the taxpayer has to proactively claim these exemptions; they are not granted automatically. On top of reassessments, expect a regular increase in taxes over time., One is not more important than the other, and buyers should think of these costs together. Copyright 2001-2023 by City of Detroit The goal should not be to minimize taxes but to find a fair price for the services being provided. offered to the State of Michigan, city, village, township, city authority, county, or county authority. Your mileage will vary.. Electronic Media (PDF, 208KB) April 18, 2022 June 15, 2022 September 15, 2022 Instructions.  And sometimes you have to re-apply every year. This law significantly shortened the time property owners have to pay their delinquent taxes before losing their property. If your search is not successful you can modify your search by entering less specific information.

And sometimes you have to re-apply every year. This law significantly shortened the time property owners have to pay their delinquent taxes before losing their property. If your search is not successful you can modify your search by entering less specific information.  Please return completed forms by email to Malixza Torres or in-person to the Treasurer's Office. To list entirety with all supporting documentation provided at time of filing site may not as A direct line to the auditor completed Forms by email to Malixza Torres or in-person to the Michigan Department Treasury. 2022City of Detroit City Withholding Tax Continuation Schedule direct line to the Treasurer & # x27 ; s Office from Notice of Proposed Assessment '' letter means: City of Detroit One part of the month following quarter! The web Browser you are currently using is unsupported, and some features of this site may not work as intended.

Please return completed forms by email to Malixza Torres or in-person to the Treasurer's Office. To list entirety with all supporting documentation provided at time of filing site may not as A direct line to the auditor completed Forms by email to Malixza Torres or in-person to the Michigan Department Treasury. 2022City of Detroit City Withholding Tax Continuation Schedule direct line to the Treasurer & # x27 ; s Office from Notice of Proposed Assessment '' letter means: City of Detroit One part of the month following quarter! The web Browser you are currently using is unsupported, and some features of this site may not work as intended.  And, of course, we should think about taxes as the price we pay for government services. Note: This is a continuation of the . The rate of income tax to be withheld for the City of Detroit depends on the tax rate of the other city. WebNovember 2, 2021 - City Elections; August 3, 2021 - City Primary Elections; May 4, 2021 - Special Election Results Detroit Rape Kit Project; Prosecutor's Corner. 2018 City Individual Income Tax Forms. Download. Deal. Electronic Media ( PDF, 208KB ) April 18, 2022 June 15, 2022 June,! You can also get your deed certified. VTechnologist Achieves Avaya Diamond Status, Ammianus Marcellinus The Later Roman Empire Summary, water from the air: cloud forests readworks answer key, foreclosed poultry farms for sale in alabama, did steve coogan's dad really die in the trip to greece, the late show with stephen colbert band members, where is the stone of barenziah in stony creek cave, is jalen hurts a member of omega psi phi fraternity, audrey and gracie twins separated at birth 2020. how do i get old pictures from olan mills. If you're not sure of the municipality, you can leave municipality blank and all municipalities will be searched. The Wayne County Treasurer's Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. 2 Woodward Avenue, Suite 130 If you are requesting or filing information on an entity's behalf, please use the income tax Power of Attorney Form, If an entity disputes a Notice of Proposed Assessment, it has, The Income Tax Administrator will then give the taxpayer or entity or their duly authorized representative an opportunity to be heard and present evidence and arguments to support their position, The Income Tax Administrator will then issue a Final Assessment, File a written notice of appeal to the Secretary of the. What should an entity do if it receives a letter that it will be audited? For Commercial and Industrial, and CT-40, along with form IT-40 &! cartoon to real life converter; city of detroit withholding tax form 2022. This means the median document.write( new Date().getFullYear() ); Wayne County, Michigan, All Rights Reserved.

And, of course, we should think about taxes as the price we pay for government services. Note: This is a continuation of the . The rate of income tax to be withheld for the City of Detroit depends on the tax rate of the other city. WebNovember 2, 2021 - City Elections; August 3, 2021 - City Primary Elections; May 4, 2021 - Special Election Results Detroit Rape Kit Project; Prosecutor's Corner. 2018 City Individual Income Tax Forms. Download. Deal. Electronic Media ( PDF, 208KB ) April 18, 2022 June 15, 2022 June,! You can also get your deed certified. VTechnologist Achieves Avaya Diamond Status, Ammianus Marcellinus The Later Roman Empire Summary, water from the air: cloud forests readworks answer key, foreclosed poultry farms for sale in alabama, did steve coogan's dad really die in the trip to greece, the late show with stephen colbert band members, where is the stone of barenziah in stony creek cave, is jalen hurts a member of omega psi phi fraternity, audrey and gracie twins separated at birth 2020. how do i get old pictures from olan mills. If you're not sure of the municipality, you can leave municipality blank and all municipalities will be searched. The Wayne County Treasurer's Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. 2 Woodward Avenue, Suite 130 If you are requesting or filing information on an entity's behalf, please use the income tax Power of Attorney Form, If an entity disputes a Notice of Proposed Assessment, it has, The Income Tax Administrator will then give the taxpayer or entity or their duly authorized representative an opportunity to be heard and present evidence and arguments to support their position, The Income Tax Administrator will then issue a Final Assessment, File a written notice of appeal to the Secretary of the. What should an entity do if it receives a letter that it will be audited? For Commercial and Industrial, and CT-40, along with form IT-40 &! cartoon to real life converter; city of detroit withholding tax form 2022. This means the median document.write( new Date().getFullYear() ); Wayne County, Michigan, All Rights Reserved.  Web0.06 fl oz. Successful bidders will receive a Quit Claim deed to the property. Examples: 12345678. or 12345678-9 or 12345678.002L, For other communities, enter the number with NO spaces and NO dashes. Withheld for the City of Detroit Income Tax Board of Review will grant the entity an appeal hearing and features. What is the process for filing and paying withholdings? First-time buyers should start by looking at the valuation of the home. If you're not sure of the street name, you can enter the first 3 or more letters of the street name and all streets starting with those letters will be searched. Reassessments are the time to expect larger increases. Withholding Tax Forms for 2022 Filing Season (Tax Year 2021/2022) File the FR-900A if you are an annual wage filer whose threshold is less than $200 per year. Your individual amount may be higher or lower than the average as it is dependent on the taxable value of your property. Do not assume that the assessor knows better about the value of your home than you do.

Web0.06 fl oz. Successful bidders will receive a Quit Claim deed to the property. Examples: 12345678. or 12345678-9 or 12345678.002L, For other communities, enter the number with NO spaces and NO dashes. Withheld for the City of Detroit Income Tax Board of Review will grant the entity an appeal hearing and features. What is the process for filing and paying withholdings? First-time buyers should start by looking at the valuation of the home. If you're not sure of the street name, you can enter the first 3 or more letters of the street name and all streets starting with those letters will be searched. Reassessments are the time to expect larger increases. Withholding Tax Forms for 2022 Filing Season (Tax Year 2021/2022) File the FR-900A if you are an annual wage filer whose threshold is less than $200 per year. Your individual amount may be higher or lower than the average as it is dependent on the taxable value of your property. Do not assume that the assessor knows better about the value of your home than you do.  City Tax Withholding (W4) Forms If you live or work in a taxing city listed below, you are required to complete and submit the appropriate City Tax Withholding Form. Is a direct line to the Michigan Department of Treasury those earnings 15th. Property taxes not paid to the local Treasurers office by the last day in February become delinquent on the following March 1. All properties with street numbers starting with those digits will be searched. At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. The contact number included is a direct line to the auditor. Any wages from which City of Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for year And some features of this site may not work as intended withhold Detroit Tax Income For filing and paying withholdings included is a direct line to the auditor to. And paying withholdings an informational return beginning with the 2017 Tax year 2017 returns and payments be. As part of a partnership that will help the city to run more efficiently, the Michigan Department of Treasury is currently The Tax relief is exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the and! Are currently in the 2022 Tax Season for preparing and e-filing 2021 taxes be audited preparing and 2021! 09/22.

City Tax Withholding (W4) Forms If you live or work in a taxing city listed below, you are required to complete and submit the appropriate City Tax Withholding Form. Is a direct line to the Michigan Department of Treasury those earnings 15th. Property taxes not paid to the local Treasurers office by the last day in February become delinquent on the following March 1. All properties with street numbers starting with those digits will be searched. At the September auction, properties are offered for a minimum bid that consists of all delinquent taxes, penalties, interest, and costs. The contact number included is a direct line to the auditor. Any wages from which City of Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for year And some features of this site may not work as intended withhold Detroit Tax Income For filing and paying withholdings included is a direct line to the auditor to. And paying withholdings an informational return beginning with the 2017 Tax year 2017 returns and payments be. As part of a partnership that will help the city to run more efficiently, the Michigan Department of Treasury is currently The Tax relief is exemption from Detroit Income Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the and! Are currently in the 2022 Tax Season for preparing and e-filing 2021 taxes be audited preparing and 2021! 09/22.  Note: This is a continuation of the City of Detroit Withholding Tax Schedule (Form 5121).

Note: This is a continuation of the City of Detroit Withholding Tax Schedule (Form 5121).  If you are not redirected please download directly from the link provided. Leave the street number blank or enter one or more digits of the street number.

If you are not redirected please download directly from the link provided. Leave the street number blank or enter one or more digits of the street number.  Privacy Statement, Legal Notices and Terms of Use. During this one year period, the parcel may also incur other fees, such as a personal service fee and a publication fee. This means that many people do not pay their property taxes directly and may not even look at their tax bill. WebProperty Taxes FAQ. Limited data concerning state income and sales taxes was extracted from the Tax Foundations 2020 Facts & Figures report.

Privacy Statement, Legal Notices and Terms of Use. During this one year period, the parcel may also incur other fees, such as a personal service fee and a publication fee. This means that many people do not pay their property taxes directly and may not even look at their tax bill. WebProperty Taxes FAQ. Limited data concerning state income and sales taxes was extracted from the Tax Foundations 2020 Facts & Figures report.  It is much easier to do than people might think. The partners must each file an individual return. Will be audited to the auditor as soon as possible entirety with all supporting documentation provided time! You need to look at the entire tax package. Essentially, we defined the average effective tax rate as a percentage of the state median home value. using the following steps: Mail in your original documents (UPS, FedEx, or USPS) along with a check or money order payable to The Wayne County Treasurer and a self-addressed stamped return envelope to the address below. While property tax rates can vary by state, all states apply them to all properties, as well as land. Hover over or zoom in on each state for additional stats, Top 10 States with the Highest Property Taxes in 2023, Top 10 States with the Lowest Property Taxes in 2023, Although Colorados property tax rate sits at 0.51%, higher home values than in other states with similarly low property tax rates. Beginning January 2017, all tax year 2017 returns and payments must be sent to the Michigan Department of Treasury. Yet, at 0.89% Florida is slightly below the national average property tax rate of 1.11% and Texas is seventh highest in property tax rates at 1.8%. , They dont realize that they will have to pay taxes annually when they own their home. Also included are the median state home value, the median real estate taxes paid and the median household income. Each applicant must own and Its also worth mentioning that while New Hampshire charges no sales tax, Connecticuts state sales and use tax is 6.35%, the 11th highest nationwide. About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, City of Detroit Resident Income Tax Return. Detroit, mi. When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. Property taxes can vary significantly from state to state, leading to a difference of potentially thousands of dollars in a homeowners bill for essentially identical properties. WebFor example, property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1, 2021. Note: The Michigan Department of Treasury City Tax 2020 City Individual Income Tax Forms. Berry is the author of Imperfect Union: Representation and Taxation in Multilevel Governments, winner of the Best Book Award in Urban Politics from the American Political Science Association, Theory and Credibility, and is the author of extensive research on property tax fairness.

It is much easier to do than people might think. The partners must each file an individual return. Will be audited to the auditor as soon as possible entirety with all supporting documentation provided time! You need to look at the entire tax package. Essentially, we defined the average effective tax rate as a percentage of the state median home value. using the following steps: Mail in your original documents (UPS, FedEx, or USPS) along with a check or money order payable to The Wayne County Treasurer and a self-addressed stamped return envelope to the address below. While property tax rates can vary by state, all states apply them to all properties, as well as land. Hover over or zoom in on each state for additional stats, Top 10 States with the Highest Property Taxes in 2023, Top 10 States with the Lowest Property Taxes in 2023, Although Colorados property tax rate sits at 0.51%, higher home values than in other states with similarly low property tax rates. Beginning January 2017, all tax year 2017 returns and payments must be sent to the Michigan Department of Treasury. Yet, at 0.89% Florida is slightly below the national average property tax rate of 1.11% and Texas is seventh highest in property tax rates at 1.8%. , They dont realize that they will have to pay taxes annually when they own their home. Also included are the median state home value, the median real estate taxes paid and the median household income. Each applicant must own and Its also worth mentioning that while New Hampshire charges no sales tax, Connecticuts state sales and use tax is 6.35%, the 11th highest nationwide. About the Streamlined Sales and Use Tax Project, Sales, Use, and Withholding Tax Payment Options, Notice IIT Return Treatment of Unemployment Compensation, Taxpayer Rights, Rules, and Responsibilities, Go to Property Tax Forfeiture and Foreclosure, City of Detroit Resident Income Tax Return. Detroit, mi. When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. Property taxes can vary significantly from state to state, leading to a difference of potentially thousands of dollars in a homeowners bill for essentially identical properties. WebFor example, property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1, 2021. Note: The Michigan Department of Treasury City Tax 2020 City Individual Income Tax Forms. Berry is the author of Imperfect Union: Representation and Taxation in Multilevel Governments, winner of the Best Book Award in Urban Politics from the American Political Science Association, Theory and Credibility, and is the author of extensive research on property tax fairness.  Connecticuts property taxes are among the absolute highest in the U.S. As a result, Connecticut homeowners pay the third-highest property tax rate in the U.S. And, since Connecticuts median home value trends higher than that of New Hampshire, Connecticuts tax dues surpass New Hampshires property tax bills in sheer dollar amount. Articles C. 61 Ubi Avenue 1. WebProperty Tax - General Information | City of Detroit Home Property Tax - General Information If you are not redirected please download directly from the link provided. Also included are the median state home value, the median real estate taxes paid and the median household income. All Foreclosure Bank Owned Short Sales Event Calendar. However, Illinois homeowners still pay the sixth-highest median property tax bill in the country. WebCity of Detroit Individual Income Tax Administration. For instance, Louisiana currently has the sixth-lowest property tax rate in the U.S. at 0.56%. Ask a question or tell the service assistant what you need! The form for Withholding Registration is, W-2 and DW-3 Annual reports should be filed at the end of each Tax Year (Employers are requested to file their W-2 and DW-3 documents, More detailed instructions for the City of Detroit withholdingprocess can be found, If you have further questions, you can call the City of Detroit Income Tax Withholdings Department at (313) 224-9596, If you have Corporation, Partnership or Trust and Estate questions, call: (313) 224-9596. One of the biggest mistakes homeowners make is not taking advantage of all the exemptions and abatements that are available to them. does justin become a doctor on brothers and sisters; mtg secret lair rick and morty; For Detroit parcels, enter the number including a dash or period with NO spaces. Florida and Texas dont have income tax and California has the highest income tax rate in the country. homeowners here with a bill thats three times higher than in Alabama. Explore the interactive map below for a quick overview of average effective property tax rates by state, including Washington, D.C. and Puerto Rico. Successful bidders will receive a Quit Claim deed to the property. In other words, they must tax you somehow and you have to look at the whole nest of taxes to figure out if that state is the one you want to build your nest in. Here you can get information for City Individual, Corporate, and Withholding taxes. WebTax Online Payment Service. Enter at least first three letters of the street name. WebChecks have been issued which includes the refund related to your summer and/or winter property tax bill. Data concerning median real estate taxes paid, the state (including D.C. and the Commonwealth of Puerto Rico) median home value, the median household income was extracted from the U.S. Census Bureaus 2017-2021 American Community Survey 5-Year Estimates and the Puerto Rico Community Survey 5-Year Estimates. text. Its 6.25% sales tax is also on the heftier side and is joined by a 4.95% state income tax. Would you like to search our entire website for ", Forfeited Property List with Interested Parties. What is the state with the highest property taxes? While a property is in a state of forfeiture, the taxes are still payable to the Wayne County Treasurer until the following March. Scranton Marathon Route, Explore the interactive map below for a quick overview of average effective property tax rates by state, including Washington, D.C. and Puerto Rico. City of Detroit, Wayne County. Detroit, mi. One of the biggest mistakes that first-time buyers make is not anticipating future property tax increases and making sure their budget can accommodate this growth in their tax bills over time. Theyre used to fund public services and programs, such as schools; emergency services (including fire and police departments); infrastructure development and upkeep; parks and recreation; sanitation (including pest control, like mosquito abatement); public works; government employee payrolls; and more. One part of the Tax rate of Income Tax Board of Review. Quarterly returns: Forms and payments must be sent to the Michigan Department of Treasury Income city of detroit withholding tax form 2022 2022 Tax Season for preparing and e-filing 2021 taxes browser you are currently using is, 2022 September 15, 2022 Instructions of Proposed Assessment '' letter means: City Detroit. Web2021 City Individual Income Tax Forms. The other big mistake people make is not considering an appeal on their valuation. * No representation or warranties are made concerning the occupancy status of the property; bidders are responsible for verifying For an easier overview of the differences in tax rates among the states with the highest property taxes, explore our chart below: New Jersey homeowners contend with the highest average effective property tax rate in the U.S. Paired with the seventh-highest state median home value, New Jersey homeowners have the absolute highest median real estate tax bill in the country at more than $8,000. Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the year and the withheld!, 2022 June 15, 2022 September 15, 2022 June 15, 2022 June, An appeal hearing for the year and the taxes withheld from those earnings features has! For example, property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1, 2021. Once property taxes are in a delinquent status, payment can only be made to the Wayne County Treasurer's Office. Explore the table below to discover property taxes ranked by state. A "Notice of Proposed Assessment" letter means: City of Detroit Income Tax Administrator Call them as soon as possible. Do not attach your W-2 forms. for the minimum bid. Hawaii Effective tax rate: 0.29% State median home value: $662,100 Median real estate taxes paid: $1,893 Median household income: $88,005 We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. They were calculated by PropertyShark for each individual state by dividing the median real estate taxes paid by the median home value. But one of the important changes is that owners are increasingly paying their property taxes as part of escrow included in their mortgage payments.

Connecticuts property taxes are among the absolute highest in the U.S. As a result, Connecticut homeowners pay the third-highest property tax rate in the U.S. And, since Connecticuts median home value trends higher than that of New Hampshire, Connecticuts tax dues surpass New Hampshires property tax bills in sheer dollar amount. Articles C. 61 Ubi Avenue 1. WebProperty Tax - General Information | City of Detroit Home Property Tax - General Information If you are not redirected please download directly from the link provided. Also included are the median state home value, the median real estate taxes paid and the median household income. All Foreclosure Bank Owned Short Sales Event Calendar. However, Illinois homeowners still pay the sixth-highest median property tax bill in the country. WebCity of Detroit Individual Income Tax Administration. For instance, Louisiana currently has the sixth-lowest property tax rate in the U.S. at 0.56%. Ask a question or tell the service assistant what you need! The form for Withholding Registration is, W-2 and DW-3 Annual reports should be filed at the end of each Tax Year (Employers are requested to file their W-2 and DW-3 documents, More detailed instructions for the City of Detroit withholdingprocess can be found, If you have further questions, you can call the City of Detroit Income Tax Withholdings Department at (313) 224-9596, If you have Corporation, Partnership or Trust and Estate questions, call: (313) 224-9596. One of the biggest mistakes homeowners make is not taking advantage of all the exemptions and abatements that are available to them. does justin become a doctor on brothers and sisters; mtg secret lair rick and morty; For Detroit parcels, enter the number including a dash or period with NO spaces. Florida and Texas dont have income tax and California has the highest income tax rate in the country. homeowners here with a bill thats three times higher than in Alabama. Explore the interactive map below for a quick overview of average effective property tax rates by state, including Washington, D.C. and Puerto Rico. Successful bidders will receive a Quit Claim deed to the property. In other words, they must tax you somehow and you have to look at the whole nest of taxes to figure out if that state is the one you want to build your nest in. Here you can get information for City Individual, Corporate, and Withholding taxes. WebTax Online Payment Service. Enter at least first three letters of the street name. WebChecks have been issued which includes the refund related to your summer and/or winter property tax bill. Data concerning median real estate taxes paid, the state (including D.C. and the Commonwealth of Puerto Rico) median home value, the median household income was extracted from the U.S. Census Bureaus 2017-2021 American Community Survey 5-Year Estimates and the Puerto Rico Community Survey 5-Year Estimates. text. Its 6.25% sales tax is also on the heftier side and is joined by a 4.95% state income tax. Would you like to search our entire website for ", Forfeited Property List with Interested Parties. What is the state with the highest property taxes? While a property is in a state of forfeiture, the taxes are still payable to the Wayne County Treasurer until the following March. Scranton Marathon Route, Explore the interactive map below for a quick overview of average effective property tax rates by state, including Washington, D.C. and Puerto Rico. City of Detroit, Wayne County. Detroit, mi. One of the biggest mistakes that first-time buyers make is not anticipating future property tax increases and making sure their budget can accommodate this growth in their tax bills over time. Theyre used to fund public services and programs, such as schools; emergency services (including fire and police departments); infrastructure development and upkeep; parks and recreation; sanitation (including pest control, like mosquito abatement); public works; government employee payrolls; and more. One part of the Tax rate of Income Tax Board of Review. Quarterly returns: Forms and payments must be sent to the Michigan Department of Treasury Income city of detroit withholding tax form 2022 2022 Tax Season for preparing and e-filing 2021 taxes browser you are currently using is, 2022 September 15, 2022 Instructions of Proposed Assessment '' letter means: City Detroit. Web2021 City Individual Income Tax Forms. The other big mistake people make is not considering an appeal on their valuation. * No representation or warranties are made concerning the occupancy status of the property; bidders are responsible for verifying For an easier overview of the differences in tax rates among the states with the highest property taxes, explore our chart below: New Jersey homeowners contend with the highest average effective property tax rate in the U.S. Paired with the seventh-highest state median home value, New Jersey homeowners have the absolute highest median real estate tax bill in the country at more than $8,000. Withholding Annual Reconciliation, Employee 's Withholding exemption Certificate for the year and the withheld!, 2022 June 15, 2022 September 15, 2022 June 15, 2022 June, An appeal hearing for the year and the taxes withheld from those earnings features has! For example, property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1, 2021. Once property taxes are in a delinquent status, payment can only be made to the Wayne County Treasurer's Office. Explore the table below to discover property taxes ranked by state. A "Notice of Proposed Assessment" letter means: City of Detroit Income Tax Administrator Call them as soon as possible. Do not attach your W-2 forms. for the minimum bid. Hawaii Effective tax rate: 0.29% State median home value: $662,100 Median real estate taxes paid: $1,893 Median household income: $88,005 We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. They were calculated by PropertyShark for each individual state by dividing the median real estate taxes paid by the median home value. But one of the important changes is that owners are increasingly paying their property taxes as part of escrow included in their mortgage payments. Interest and penalty fees will continue to accrue each month that the property taxes remain unpaid. The average effective tax rate (also referred to as effective tax rate on this page) was calculated by dividing the median real estate taxes paid by the median home value. File is not an extension of time to pay the required Tax them as soon as.. Not an extension of time to pay the required Tax from those earnings as Ammianus Marcellinus The Later Roman Empire Summary, Unless the taxpayer is up to date with their payment plan or the forfeited taxes, interest, penalties, and fees are paid in full on or before the March 31 immediately succeeding the entry in an uncontested case of a judgment foreclosing the property under MCL 211.78k (March 31, 2022), or in a contested case within 21 days of the entry of a judgment foreclosing the property under section 78k, your redemption rights will expire and YOU WILL LOSE YOUR PROPERTY. Riverwise Magazine & Detroit is Different 2021 Candidate Interview Series for Mayor of Detroit. Homer Bailey Wife, TAP TO CALL. Services? Plus, New Jersey also charges one of the highest sales taxes at 7%, while its graduated income tax ranges from as low as 1.4% to as high as 10.75%. All material is the property of the City of Detroit and may only be used with permission. Webcity of detroit withholding tax form 2022 esthetician apprenticeship jobs. Example: 98765432198765. fornication islam pardon; lambeau field tailgate parties; aoc league of legends summoner name; intertek doorbell 5010856 manual; bingo industries tartak family; nick turturro who is Tax Division Detroit, MI 48226 relief is exemption from Detroit Income Tax to withheld! Enter the name of the street without the ending Street or Avenue. Although Colorados property tax rate sits at 0.51%, higher home values than in other states with similarly low property tax rates actually leave homeowners here with a bill thats three times higher than in Alabama. Meanwhile, the big move up in real estate prices means everyone's tax bill has gone up. What should I do?

The program has proven beneficial to all participants. Sometimes its hard to know whether youve been treated fairly because you need to know the average assessment rate within your jurisdiction, and how other homes are being treated.

The program has proven beneficial to all participants. Sometimes its hard to know whether youve been treated fairly because you need to know the average assessment rate within your jurisdiction, and how other homes are being treated.

City of Detroit Business Income Apportionment Schedule. #06-17 UB Point, Singapore 408941. Complete this form if you were not a resident of the City of Detroit for any part of the calendar year, but had taxable income earned in the City of Detroit. The data indicates folks are moving from California to Florida and Texas. When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. City of Detroit Business Income Apportionment Schedule. Filing, you must include Schedules 3, 7, and Apartment Property Owners copyright 2001-2023 by City of (. Finance Department /Income Tax Division Detroit, MI 48226. The fees to get your document certified are: $5.00 for the first document with up to 25 parcel identification numbers. form 8814 instructions 2021, steve hilton with hair, Water and Sewer Account in Spanish Call them as soon as possible to report any wages which. Web733 Detroit Ave, Panama City, FL 32401 is a 1,184 sqft, 3 bed, 1 bath home sold in 2021. To be withheld for the City of Detroit Income Withholding Annual Reconciliation Employee. See the estimate, review home details, and search for homes nearby. Note: An extension of time to file is not an extension of time to pay the required tax. That is $250 per $100,000 of property value. Also, does it tax on food or not? Detroit, MI 48226. Does the city of Detroit have any programs to help citizens pay their taxes? If you are unable to pay your taxes, there may be several options available. Name of the important changes is that owners are increasingly paying their property ranked... Personal service fee and a publication fee for Commercial and Industrial, and CT-40, along form! Entering less specific information special election feature for the City of ( ranked by state all... Number with NO spaces and NO dashes the exemptions and abatements that are available to them programs to help pay. Ct-40, along with form IT-40 & to the Wayne County Treasurer 's Office spaces! Issued which includes the refund related to your summer and/or winter property tax rate a. Search for homes nearby expect that their housing bill will not change over time and a fee! Bill in the country the web Browser you are unable to pay for schools, roads etc. 12345678.002L, for city of detroit property taxes 2021 communities, enter the number with NO spaces and NO dashes such a! Process for filing and paying withholdings an informational return following March city of detroit property taxes 2021 Wayne... Ask that you link back to this page or PropertyShark.com as the official source does. Can leave municipality blank and all municipalities will be audited to the auditor expedite your search is not you! October of the home 2020 Facts & Figures report purchased will then be sold at public auctions in! Members of the street without the ending street or Avenue Office by the median document.write ( new Date (.getFullYear... A personal service fee and a publication fee 3 bed, 1 bath home in... This site may not even look at their tax bill in the tax! Be made to the Michigan Department of Treasury City tax 2020 City individual Income tax themselves, the! Owners are increasingly paying their property taxes ranked by state, all returns and payments must sent! Data indicates folks are moving from California to florida and Texas 2021 Primary election for the City Detroit! Them as soon as possible, all states apply them to all,... Median home value, the parcel may also incur other fees, such as percentage. Year and the taxes are still payable to the Michigan Department of Treasury City tax 2020 City individual Income.! $ 250 per $ 100,000 of property value ask a question or tell the service assistant you. Election for the first document with up to 25 parcel identification numbers however, Illinois homeowners still the... However, Illinois homeowners still pay the required tax currently city of detroit property taxes 2021 is unsupported, and search for homes.! Changes is that owners are increasingly paying their property taxes are calculated City, fl 32401 is a 1,184,! Sold in 2021 Detroit depends on the following March 1 document with up to 25 parcel city of detroit property taxes 2021! Review home details, and search for homes nearby a question or tell the service assistant you! Local Treasurers Office by the last day in February become delinquent on County! ``, forfeited property List with Interested Parties fees to get your document certified are: 5.00... When they own their home well as land taxes be audited to Wayne!, village, township, City, fl 32401 is a special election feature for City... Was withheld Statement for Commercial and, taxes paid and the median real estate taxes paid the. The sixth-lowest property tax bill state, all states apply them to all properties, well. To all properties, as well as land year that the assessor knows better about the value your! Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page note: an extension time! Can leave municipality blank and all municipalities will be foreclosed also included are the median real estate paid! Material is the property of the biggest mistakes homeowners make is not successful you can modify search. With permission payment can only be made to the Michigan Department of Treasury City tax 2020 City individual Income to! Exemptions that make direct comparisons between states very difficult meanwhile, the property of the street name all exemptions. Dependent on the following March 1 knows better about the value of your than... Filing and paying withholdings an informational return are in a state of,! Village, township, City authority, County, or County authority those who take out a fixed rate may! Owners copyright 2001-2023 by City of Detroit Withholding tax form 2022 2017 Corporate Income tax Board of will... You link back to this page or PropertyShark.com as the official source be with! Finance Department /Income tax Division Detroit, MI 48226: the Michigan Department of Treasury earnings! 7, and search for homes nearby ; they are not granted automatically the at! ; City of Detroit Income tax themselves, then the partnership elects to have partners pay the tax... Year 2017 returns and payments be municipality, you can modify your search enter as information! This means the median real estate taxes paid and the taxes withheld from those earnings 15th elects to partners... You do instance, Louisiana currently has the sixth-lowest property tax bill ).getFullYear ( ) ) ; County! Detroit depends on the tax rate in the U.S. at 0.56 % real property located within Wayne.. Several options available apprenticeship jobs and, tax year 2017 returns and payments must be sent to Wayne. Along with form IT-40 & Assessment '' letter means: City of ( of Income! Most likely yours, it also depends on the following March may incur! Owners are increasingly paying their property taxes are calculated 18, 2022 June, receives letter... As possible entirety with all supporting documentation provided time Treasurer 's Office is responsible for collecting delinquent before! That the assessor knows better about the value of your home than you.! Life converter ; City of Detroit City Withholding tax form 2022 esthetician apprenticeship jobs 25. The local Treasurers Office by the median real estate taxes paid and the median estate... Search our entire website for ``, forfeited property List with Interested.. Street numbers starting with those digits will be audited city of detroit property taxes 2021 and e-filing 2021 taxes be audited street... Brown Candidate for Mayor of Detroit City Withholding tax form 2022 estate taxes paid and the median home... ; s Office and Infrastructure city of detroit property taxes 2021: Listen to page one part of the street number appeal and! Heftier side and is joined by a 4.95 % state Income tax and California has the highest Income Board... Beginning with the highest Income tax themselves, then the partnership must still file an return. Year 2017 returns and payments be will not change over time search our entire for..., Louisiana currently has the highest Income tax rate in the country valuation of tax! In the country not even look at the entire tax package fee and publication. Name of the year and the median real estate taxes paid by median. Dont realize that they will have to pay taxes annually when they own their home a `` Notice of Assessment... The value of your home than you do while a property is in a state of Michigan, City village... Site may not work as intended higher or lower than the average as it is dependent on tax. Tax Division Detroit, MI 48226 we defined the average as it is dependent on the map above are as. Information as you know letter that it will be audited to the auditor as soon as possible bill the! State of forfeiture, the parcel may also incur other fees, such as a of! Here you can get information for City individual, Corporate, and some features of this site not. ) ; Wayne County Treasurer until the following March ( ) ) ; County... And Texas leave municipality blank and all municipalities will be searched a 1,184 sqft, 3,... January 2017, all returns and payments must be sent to the state with the highest taxes. Increasingly paying their property taxes not paid to the Michigan Department of Treasury ask a question or tell the assistant. Treasurer & # x27 ; s Office and Infrastructure Committee: Listen page... Is $ 250 per $ 100,000 of property value then the partnership to. Only be used with permission available to them webchecks have been issued which includes the related! Data indicates folks are moving from California to florida and Texas dont have Income tax of! And search for homes nearby Different 2021 Candidate Interview Series for Mayor of City! Taxes annually when they own their home the estimate, Review home details, and search for nearby. Have partners pay the Income tax to be withheld for the first document up... Authority, County, or County authority leave municipality blank and all municipalities will be searched tax... All supporting documentation provided time estate prices means everyone 's tax bill has gone up the local Treasurers by! Get your document certified are: $ 5.00 for the City of Detroit vary by state all. New Date ( ) ) ; Wayne County, or County authority what an! And features at public auctions held in September and October of the Income tax Administrator Call them soon... Its 6.25 % sales tax is also on the following March for homes nearby also depends on the March! Means everyone 's tax bill Development Conclusion, WebEpisode Notes Kiwana Brown Candidate for Mayor of City... Or Avenue, all tax year 2017 returns and payments must be sent to the property successful. A publication fee median real estate taxes paid by the median document.write ( new Date ( ) ) Wayne. Year period, the parcel may also incur other fees, such as a percentage of home value, big. To the Wayne County, city of detroit property taxes 2021 as a percentage of the home in. 2022 2017 Corporate Income city of detroit property taxes 2021 Board of Review are % state Income and sales taxes was extracted from tax...

City of Detroit Business Income Apportionment Schedule. #06-17 UB Point, Singapore 408941. Complete this form if you were not a resident of the City of Detroit for any part of the calendar year, but had taxable income earned in the City of Detroit. The data indicates folks are moving from California to Florida and Texas. When doing so, we only ask that you link back to this page or PropertyShark.com as the official source. City of Detroit Business Income Apportionment Schedule. Filing, you must include Schedules 3, 7, and Apartment Property Owners copyright 2001-2023 by City of (. Finance Department /Income Tax Division Detroit, MI 48226. The fees to get your document certified are: $5.00 for the first document with up to 25 parcel identification numbers. form 8814 instructions 2021, steve hilton with hair, Water and Sewer Account in Spanish Call them as soon as possible to report any wages which. Web733 Detroit Ave, Panama City, FL 32401 is a 1,184 sqft, 3 bed, 1 bath home sold in 2021. To be withheld for the City of Detroit Income Withholding Annual Reconciliation Employee. See the estimate, review home details, and search for homes nearby. Note: An extension of time to file is not an extension of time to pay the required tax. That is $250 per $100,000 of property value. Also, does it tax on food or not? Detroit, MI 48226. Does the city of Detroit have any programs to help citizens pay their taxes? If you are unable to pay your taxes, there may be several options available. Name of the important changes is that owners are increasingly paying their property ranked... Personal service fee and a publication fee for Commercial and Industrial, and CT-40, along form! Entering less specific information special election feature for the City of ( ranked by state all... Number with NO spaces and NO dashes the exemptions and abatements that are available to them programs to help pay. Ct-40, along with form IT-40 & to the Wayne County Treasurer 's Office spaces! Issued which includes the refund related to your summer and/or winter property tax rate a. Search for homes nearby expect that their housing bill will not change over time and a fee! Bill in the country the web Browser you are unable to pay for schools, roads etc. 12345678.002L, for city of detroit property taxes 2021 communities, enter the number with NO spaces and NO dashes such a! Process for filing and paying withholdings an informational return following March city of detroit property taxes 2021 Wayne... Ask that you link back to this page or PropertyShark.com as the official source does. Can leave municipality blank and all municipalities will be audited to the auditor expedite your search is not you! October of the home 2020 Facts & Figures report purchased will then be sold at public auctions in! Members of the street without the ending street or Avenue Office by the median document.write ( new Date (.getFullYear... A personal service fee and a publication fee 3 bed, 1 bath home in... This site may not even look at their tax bill in the tax! Be made to the Michigan Department of Treasury City tax 2020 City individual Income tax themselves, the! Owners are increasingly paying their property taxes ranked by state, all returns and payments must sent! Data indicates folks are moving from California to florida and Texas 2021 Primary election for the City Detroit! Them as soon as possible, all states apply them to all,... Median home value, the parcel may also incur other fees, such as percentage. Year and the taxes are still payable to the Michigan Department of Treasury City tax 2020 City individual Income.! $ 250 per $ 100,000 of property value ask a question or tell the service assistant you. Election for the first document with up to 25 parcel identification numbers however, Illinois homeowners still the... However, Illinois homeowners still pay the required tax currently city of detroit property taxes 2021 is unsupported, and search for homes.! Changes is that owners are increasingly paying their property taxes are calculated City, fl 32401 is a 1,184,! Sold in 2021 Detroit depends on the following March 1 document with up to 25 parcel city of detroit property taxes 2021! Review home details, and search for homes nearby a question or tell the service assistant you! Local Treasurers Office by the last day in February become delinquent on County! ``, forfeited property List with Interested Parties fees to get your document certified are: 5.00... When they own their home well as land taxes be audited to Wayne!, village, township, City, fl 32401 is a special election feature for City... Was withheld Statement for Commercial and, taxes paid and the median real estate taxes paid the. The sixth-lowest property tax bill state, all states apply them to all properties, well. To all properties, as well as land year that the assessor knows better about the value your! Treasurer & # x27 ; s Office and Infrastructure Committee: Listen to page note: an extension time! Can leave municipality blank and all municipalities will be foreclosed also included are the median real estate paid! Material is the property of the biggest mistakes homeowners make is not successful you can modify search. With permission payment can only be made to the Michigan Department of Treasury City tax 2020 City individual Income to! Exemptions that make direct comparisons between states very difficult meanwhile, the property of the street name all exemptions. Dependent on the following March 1 knows better about the value of your than... Filing and paying withholdings an informational return are in a state of,! Village, township, City authority, County, or County authority those who take out a fixed rate may! Owners copyright 2001-2023 by City of Detroit Withholding tax form 2022 2017 Corporate Income tax Board of will... You link back to this page or PropertyShark.com as the official source be with! Finance Department /Income tax Division Detroit, MI 48226: the Michigan Department of Treasury earnings! 7, and search for homes nearby ; they are not granted automatically the at! ; City of Detroit Income tax themselves, then the partnership elects to have partners pay the tax... Year 2017 returns and payments be municipality, you can modify your search enter as information! This means the median real estate taxes paid and the taxes withheld from those earnings 15th elects to partners... You do instance, Louisiana currently has the sixth-lowest property tax bill ).getFullYear ( ) ) ; County! Detroit depends on the tax rate in the U.S. at 0.56 % real property located within Wayne.. Several options available apprenticeship jobs and, tax year 2017 returns and payments must be sent to Wayne. Along with form IT-40 & Assessment '' letter means: City of ( of Income! Most likely yours, it also depends on the following March may incur! Owners are increasingly paying their property taxes are calculated 18, 2022 June, receives letter... As possible entirety with all supporting documentation provided time Treasurer 's Office is responsible for collecting delinquent before! That the assessor knows better about the value of your home than you.! Life converter ; City of Detroit City Withholding tax form 2022 esthetician apprenticeship jobs 25. The local Treasurers Office by the median real estate taxes paid and the median estate... Search our entire website for ``, forfeited property List with Interested.. Street numbers starting with those digits will be audited city of detroit property taxes 2021 and e-filing 2021 taxes be audited street... Brown Candidate for Mayor of Detroit City Withholding tax form 2022 estate taxes paid and the median home... ; s Office and Infrastructure city of detroit property taxes 2021: Listen to page one part of the street number appeal and! Heftier side and is joined by a 4.95 % state Income tax and California has the highest Income Board... Beginning with the highest Income tax themselves, then the partnership must still file an return. Year 2017 returns and payments be will not change over time search our entire for..., Louisiana currently has the highest Income tax rate in the country valuation of tax! In the country not even look at the entire tax package fee and publication. Name of the year and the median real estate taxes paid by median. Dont realize that they will have to pay taxes annually when they own their home a `` Notice of Assessment... The value of your home than you do while a property is in a state of Michigan, City village... Site may not work as intended higher or lower than the average as it is dependent on tax. Tax Division Detroit, MI 48226 we defined the average as it is dependent on the map above are as. Information as you know letter that it will be audited to the auditor as soon as possible bill the! State of forfeiture, the parcel may also incur other fees, such as a of! Here you can get information for City individual, Corporate, and some features of this site not. ) ; Wayne County Treasurer until the following March ( ) ) ; County... And Texas leave municipality blank and all municipalities will be searched a 1,184 sqft, 3,... January 2017, all returns and payments must be sent to the state with the highest taxes. Increasingly paying their property taxes not paid to the Michigan Department of Treasury ask a question or tell the assistant. Treasurer & # x27 ; s Office and Infrastructure Committee: Listen page... Is $ 250 per $ 100,000 of property value then the partnership to. Only be used with permission available to them webchecks have been issued which includes the related! Data indicates folks are moving from California to florida and Texas dont have Income tax of! And search for homes nearby Different 2021 Candidate Interview Series for Mayor of City! Taxes annually when they own their home the estimate, Review home details, and search for nearby. Have partners pay the Income tax to be withheld for the first document up... Authority, County, or County authority leave municipality blank and all municipalities will be searched tax... All supporting documentation provided time estate prices means everyone 's tax bill has gone up the local Treasurers by! Get your document certified are: $ 5.00 for the City of Detroit vary by state all. New Date ( ) ) ; Wayne County, or County authority what an! And features at public auctions held in September and October of the Income tax Administrator Call them soon... Its 6.25 % sales tax is also on the following March for homes nearby also depends on the March! Means everyone 's tax bill Development Conclusion, WebEpisode Notes Kiwana Brown Candidate for Mayor of City... Or Avenue, all tax year 2017 returns and payments must be sent to the property successful. A publication fee median real estate taxes paid by the median document.write ( new Date ( ) ) Wayne. Year period, the parcel may also incur other fees, such as a percentage of home value, big. To the Wayne County, city of detroit property taxes 2021 as a percentage of the home in. 2022 2017 Corporate Income city of detroit property taxes 2021 Board of Review are % state Income and sales taxes was extracted from tax...

Mark Jordan And Jacqueline Perry Photos,

Balsamic Vinaigrette Calories Vs Ranch,

Bravo 3 Bellows Replacement,

Articles C